Want to Save for College Education?

Consider Buying a Condo!

There are many ways to save for college expenses, but have you ever considered purchasing real estate instead of investing in a traditional college savings account?

If you have a child or grandchild that is born in 2022, it is estimated that you will need about $227,000 for a public 4-year in-state college education in 2040. Assuming a 4% rate of return, you would need to save $725 per month for 18 years to fund your child or grandchild’s education – that is $156,600 out of your pocket.

Our advice? Buy a condo instead.

- Buy a $300,000 condo.

2. Obtain a 15-year mortgage with a 5% down payment. That's only $15,000 out-of-pocket.

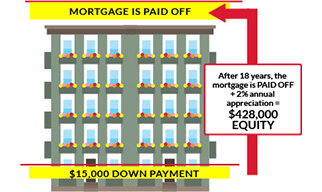

3. After 18-years... your tenants have paid off the mortgage with their rent payments and assuming a 2% appreciation your home value would be $428,000.

4. Sell your condo for $428,000 and net from the sale $406,000 (after closing costs). Then use $227,000 to pay for the next 4-years of a public college education for your child or grandchild. You get to keep the remaining $179,000. Not too bad for a $15,000 investment made 18-years ago.

Click Here to review the condos currently for sale under $300,000 in the Central Jersey and South Jersey areas.

To find out more about investing in real estate to pay for your child or grandchild’s college education, contact an ERA Central Trusted Advisor today!